This study examines the role of branding in gaining competitive advantage in the consumer electronics industry. It investigates how branding influences consumer perceptions, attitudes, and behaviors

Research study methodology:

A quantitative methodology was used. A survey was administered to 51 consumers gauging responses to brand reputation, celebrity endorsements, loyalty and other branding aspects based on multi-item Likert scales. Descriptive statistical analysis was performed.

Research study results/findings:

Results showed most participants deemed branding highly important in purchase decisions and brands h4ly sway quality inferences. But variations emerged, with mixed effects of endorsements and willingness to pay premium prices.

Research study recommendations:

The findings suggest electronics brands should tailor branding strategies based on consumer segments exhibiting different branding sensitivities. Targeted promotions, emotional brand connections, managing associations and influencer partnerships could be customized for maximum resonance. Firms must strategically invest in quality-based brand building beyond just functional attributes and judiciously leverage endorsements and promotions. Experimental studies manipulating brand elements would enrich understanding.

Table of Contents

1.0 Introduction and Background. 1

1.3 Justification for the study. 2

1.4 Research question, aim and objectives. 4

1.5 Submission structure overview.. 5

2.2 Review focus and question. 7

2.3 Background and definitions. 13

2.4 Seminal research and theory. 14

2.6 Literature gap and research question that will be taken forward. 17

3.2.3 Methodological choice. 24

3.5 Population and sampling strategy. 27

3.6 Data analysis tools and techniques. 28

3.7 Study quality and limitations. 28

3.8 Ethical considerations. 28

4.0 Results/Findings and Discussion. 30

4.2 Participant demographic overview / sample overview.. 30

4.5 Findings and discussion. 50

5.0 Conclusion and Recommendations. 56

5.3 Results/findings summary. 57

5.5 Suggestions for future research. 58

Appendix A: Prisma Framework. 1

1.0 Introduction and Background

1.1 Chapter introduction

The consumer electronics industry has grown significantly in recent years but has also faced intense competition. Branding is crucial for organisations to obtain a competitive edge in this cutthroat market. A h4 brand may distinguish a company's goods from those of competitors, mould consumer perceptions, and ultimately affect consumer purchasing decisions. The background, purpose, aims, research questions, justification, and significance of the study are all covered in this chapter.

1.2 Study background

The consumer electronics industry has witnessed rapid evolution and intense competition in recent years. As per industry reports, the global consumer electronics market is projected to reach a value of $1 trillion by 2030, driven by emerging technologies and falling prices (Indianexpress.com, 2023). While products and features have largely become commoditized, branding has emerged as the key differentiator for companies to succeed in this sector. Branding goes beyond just name recognition or logo for consumer tech companies. Leading brands invest in crafting a unique identity and positioning in the minds of target consumers, based on associations with values like innovation, style, performance, quality, and customer experience (Trivedi and Sama, 2020). For example, Apple has built high brand equity by embedding simplicity, premium design, and an empowering user experience at the core of its branding. This helps foster an emotional connection with customers that drives preference.

Premium branding further allows companies to avoid competing purely on product features and price. Consumers are willing to pay more for brands they identify with and trust. Brand loyalty also insulation against competitors, as users stick with tried-and-true brands even when alternative options have similar features (Adams et al. 2019). New entrants without h4 branding struggle to compete in consumer electronics against established players such as Samsung, Sony, and Canon which have built high brand equity over decades. The brand reputation around performance, design, and creativity that leading companies enjoy serves as a sustainable competitive barrier.

For instance, Samsung has invested heavily in improving brand perception by enhancing product cohesion, promoting its SmartThings ecosystem, and incorporating cutting-edge technologies like artificial intelligence and 5G across products (Chavhan, 2022). The company's focus on branding has resulted in it being ranked among the top 5 global brands in 2022 as per Interbrand. However, brand leaders must relentlessly invest in R&D and marketing to keep delivering cutting-edge, high-quality products that reinforce their brand promise. In fast-changing consumer tech, no competitive advantage lasts forever. However, impactful branding provides a significant advantage by shaping consumer perceptions in a brand's favor.

The highly competitive and ever-evolving consumer electronics sector has recently transformed. For an organisation to have a competitive advantage, its resources must be used effectively. One such branding tactic that has gained popularity since the 1980s is co-branding. In order to boost sales and capitalise on the current consumer recognition of each brand, two or more businesses or items will co-brand (Zuhdi et al., 2020). Besides established players, new entrants also leverage co-branding strategies with leading brands to improve perception and sales, as noted in research by Zuhdi et al. (2020). In addition, companies able to differentiate and build h4 brand value gain an edge in the consumer tech arena (Gupta et al., 2020). Increasing brand competitiveness in consumer electronics requires developing brand value and differentiation (Gupta et al., 2020). A significant company in the market, Samsung Electronics, has proven the value of its branding efforts. Samsung's place among the top five global brands was cemented, according to Interbrand's Best Worldwide Brands 2022 rankings, by two years of double-digit brand value growth (News.samsung.com, 2022). Several factors, including the company's dedication to improving the customer experience, improved financial performance, and rising memory demand due to rising data usage, are credited with the acknowledgement of Samsung's brand value (News.samsung.com, 2022). Samsung has worked to make its products more cohesive, improve the SmartThings multi-device connection experience, and include cutting-edge technologies like AI and 5G, all of which have contributed to the brand's value growth.

These achievements by Samsung highlight the importance of branding strategies in the consumer electronic industry and their impact on brand competitiveness. Due to several new trends and cutting-edge technologies, the consumer electronics market is rapidly changing. AI, miniaturisation, the Internet of Things, improved wireless capabilities, AR, and VR are a few of them. These technologies have led to the developing of more networked, intelligent, and compact devices. With rapid innovation cycles, consumer electronics firms must continually re-invent branding and deliver branded product experiences to retain relevance and competitive advantage. No brand enjoys an unassailable position, as dynamic technologies and consumer expectations keep re-shaping the marketplace.

1.3 Justification for the study

This research holds significant importance for both academia and the consumer electronics industry. In the highly competitive consumer electronics industry, companies are struggling to differentiate their products and achieve competitive advantage solely based on technological features or pricing (Daugherty and Wilson, 2022). Many companies lack expertise in leveraging branding strategies effectively to shape consumer preferences, justify premium pricing, and insulate against competition. In the rapidly evolving industry, companies are finding it challenging to keep their brand identities and positioning relevant, fresh, and appealing to consumers (Kumar and Venkatesan, 2021). There is insufficient consumer insight on how specific branding strategies like celebrity endorsements, social media marketing and advertising campaigns impact purchase decisions.

The business problem can be framed as the need for consumer electronics companies to deploy the right branding strategies based on data-driven consumer insights in order to resonate with target consumers, establish competitive differentiation, and achieve market success and the research aims to provide exactly such insights. The results will add to the corpus of existing knowledge in marketing and branding by studying the function of branding in attaining a competitive advantage. The research's analytical conclusions will benefit businesses in the consumer electronics sector since they will help them create robust branding strategies to help them stand out from the competition and draw in customers.

This research provides data-driven insights for consumer electronics firms to make informed, strategic decisions on their branding approaches in order to resonate better with target consumers in a highly competitive market. The study offers specific understanding of how factors like brand reputation, celebrity endorsements, and promotional campaigns truly impact consumers' perceptions and purchase decisions in this sector. The findings will enable companies to optimize their marketing spend by allocating budgets to branding strategies that have the greatest influence on consumer preferences and loyalty. Intense rivalry, rapid technology breakthroughs, and shifting consumer preferences define the consumer electronics sector. For businesses functioning in this market, it is crucial to comprehend how branding contributes to attaining a competitive advantage. The importance of branding in customers' decision-making processes has been stressed in numerous researches.

Biel (1992) has emphasised, the significance of brand equity in forging a competitive advantage. All aspects of a brand's power and value, such as loyalty, affiliations, recognition, and perceived value, are covered by brand equity. Brands that stand out from rivals and garner devoted customers might gain a competitive advantage by having distinctive personalities that appeal to consumers (Kim et al., 2001). Additionally, highlighting how brand reputation and quality impact consumer preferences is Djaelani and Darmawan (2021). High-quality, well-known businesses are more likely to obtain a competitive edge by luring and keeping customers. This study offers valuable insights for businesses to develop effective branding strategies that connect with consumers and set their products apart from competitors by looking at elements such as brand recognition, reputation, loyalty, endorsements, advertising, and promotions.

1.4 Research question, aim and objectives

Aims

The aim of this research is to explore the influence of branding on gaining a competitive advantage in the consumer electronics industry.

Objectives

● To assess consumer decision-making processes and the significance of branding cues when purchasing electronic products.

● To investigate the impact of brand recognition, reputation, and loyalty on consumer preferences and purchase decisions in the electronics market.

● To examine the influence of celebrity endorsements and promotional activities as branding techniques affecting consumer perceptions and choices in the industry.

● To comparatively evaluate branding approaches adopted by leading consumer electronics companies and their contribution to achieving competitive differentiation and market success.

● To develop recommendations for consumer electronics companies on leveraging branding strategies to attract consumers and gain a competitive edge over rivals.

Research Question:

● How and to what extent does branding in terms of recognition, reputation, loyalty, celebrity endorsement, advertising, and promotional activities influence consumer decision making and contribute to competitive advantage in the consumer electronics market?

1.5 Submission structure overview

Figure 1.1: Dissertation Structure

(Source: Self-Developed)

Chapter 1 - Introduction

The introductory chapter establishes the background context, problem statement, research aims, questions, significance, and rationale. It provides an overview of the topic and foundational framework.

Chapter 2 - Literature Review

This chapter synthesizes previous research and theories related to the topic through a critical analysis of scholarly literature. Important concepts, models, debates, and gaps are highlighted to position the study.

Chapter 3 - Methodology

The methodology chapter details the research design, philosophy, approach, strategies and data collection and analysis methods used to address the aims and questions. Justifications are provided.

Chapter 4 - Results

This chapter presents the results and key descriptive findings from the data analysis without interpretation. Tables, charts, and other visuals are used to summarize the results.

Chapter 5 - Discussion

Here the results are interpreted and discussed in relation to the existing literature and framework. Implications are highlighted and conclusions drawn.

Chapter 6 - Conclusion

The final chapter recapitulates the entire dissertation, emphasises original contributions, acknowledges limitations, and suggests directions for future research.

1.6 Chapter conclusion

This chapter introduced the research topic of branding and its competitive advantage in the consumer electronics industry. The chapter concentrated on the industry's quick growth, ferocious competition, and the critical role branding plays in gaining a competitive edge. The study's context emphasised the benefits of co-branding techniques, brand value, and successful branding examples like Samsung Electronics. The research questions that will direct the study and its goals and objectives were provided. The significance of the study and its significance for academia and the consumer electronics industry was stressed. The goal of the study was outlined. An outline of the dissertation's structure was provided at the chapter's end.

2.0 Literature Review

2.1 Chapter introduction

The purpose of this literature review chapter is to summarise the research conducted on the role of branding in consumer behaviour within the consumer electronics sector. The review will address three main topics, namely, the influence of branding on the consumer's decision-making process, the influence of brand awareness and reputation on the consumer's preferences and purchasing behaviour, and the role of advertising and promotion in influencing consumer perception and decision-making.

2.2 Review focus and question

Figure 2.1: Consumer Decision-making Process

(Source: Stankevich, 2017)

The above figure highlights the consumer decision-making process that includes five stages: need recognition, information search, evaluation of alternatives, and purchase and post-purchase behaviour. Branding has a significant impact on consumer choice in the consumer electronics sector. Since people use brands to distinguish between items and evaluate them based on their perceived quality, worth, and dependability, they frequently rely on brands to inform their purchasing decisions (Zak and Hasprova, 2020). In order to foster sales percentage along with brand recognition, it is essential to establish customers' perspectives regarding the product. Branding plays a significant role in influencing customer opinions within the consumer electronics industry. On the contrary, they can use a brand in the context of its company reputation. In addition, consumers may select a brand that has been used by them previously.

In the consumer electronics industry, competitive advantage stems from a company's ability to differentiate its brand and products from competitors and establish preferential status in the target consumer's mind. Branding plays a key role in building competitive advantage by shaping positive perceptions, attracting consumer loyalty, and commanding premium pricing power. Branding can develop product differentiation in the context of their competitors to attract more customers and develop a new customer base. Furthermore, customers are inclined to pick a product based on its brand name. Building a solid brand can help the company gain a competitive edge within a similar industry or sector. Branding plays a critical role in influencing consumer decision-making when it comes to purchasing consumer electronics. In a product segment where many options have similar features and specifications on paper, the brand name often sways the consumer's choice. Brands allow customers to differentiate between products and make judgments based on perceived quality, value for money, and reliability (Qazzafi, 2019). In an industry as complex as consumer electronics, brands serve as informational cues or shortcuts that simplify the decision process for the customer.

Consumers form opinions and associations with brands based on their direct usage experiences as well as indirect sources such as advertising and word-of-mouth (Lin et al. 2019). Positive experiences with a brand build up brand equity in the consumer's mind. This brand equity shapes their preferences and purchase intent when evaluating new products. However, by investing in the right branding approaches proven to resonate with consumers, companies can gain a competitive edge through increased brand equity, consumer loyalty, justified price premiums, and insulation from price-based competition. Customers are more likely to choose a familiar, trusted brand with high equity over competing options with similar technical specs. Building h4 brand equity gives companies a significant competitive advantage by making them the preferred choice in crowded electronics categories.

Brand equity also fosters brand loyalty, where customers habitually repurchase from the same brand. Loyalty reduces brand switching behavior, even when competitors launch newer models. This strengthens the brand's market position over time. Branding enables companies to differentiate and carve out a distinct identity amid competition (Qin et al. 2021). With numerous electronics products having comparable features, branding builds symbolic value beyond just functional benefits. Factors such as brand personality, advertising style, store experience, and customer service all contribute to brand image. Companies craft brands to appeal to target consumer segments based on lifestyle aspirations and self-image. The brand's reputation for innovation, design, style, or performance provides a competitive edge in consumer electronics. Customers may pay a premium for brands recognized as high-quality status symbols. Thus, branding holds significant influence over consumer electronics purchase decisions. Companies invest heavily in building familiarity, equity, and loyalty for their brands to be the top choice in this competitive market.

In the consumer electronics industry, companies are increasingly partnering with famous individuals to advertise their products, leveraging the power of celebrity endorsements and influencer marketing (Tanwar et al., 2022). It has been observed that by tapping into the existing audience and influence of these well-known figures, this marketing approach aims to boost brand recognition, drive purchase intentions, and ultimately boost sales. Influential individuals who support a product can significantly affect how consumers feel, think, and behave. Celebrities and prominent figures are examples of these people. The endorsement of a product by well-known individuals makes it seem high-quality and approved by society, impacting customer behavior. Influencer marketing and celebrity endorsements are two marketing tactics that have the power to alter consumer behavior by developing a sense of social acceptance.

Figure 2.2: Impact of celebrity endorsements and influencer marketing in the consumer electronics industry

(Source: Self-Developed)

The above figure highlights the key ideas that indicate celebrity endorsements and influencer marketing can positively impact consumer electronics brands by enhancing visibility and awareness, shaping perceptions of quality and prestige, driving interest and trial, and so on. Celebrity endorsements and influencer marketing have become extremely popular strategies in the consumer electronics space for shaping purchase behavior and preferences. Celebrity endorsements involve prominent personalities from entertain sports or other fields appearing in advertising or branding campaigns for a consumer electronics brand. Celebrities help grab attention and convey qualities aligned with the brand image. For instance, Samsung has used brand ambassadors including actors, to promote its cutting-edge technology and style. The desirability of celebrity's transfers to the products to drive consumer aspirations and sales. Consumers perceive quality by association when celebrities endorse electronics products. In case major stars trust a brand, it stands out from competing products without famous backers. Celebrity endorsements work best when the brand and celebrity images are congruent (Roy et al. 2021). Using tech-savvy, stylish celebrities for gadgets enhances perceptions of innovation and trendiness for the brand itself.

However, celebrity endorsers can also negatively impact consumer opinions in case they become embroiled in controversies that reflect poorly on associated brands. Companies needs to carefully vet celebrities beforehand. Influencer marketing leverages people with niche followings on social media platforms such as Instagram and YouTube to promote consumer electronics (Gaurav et al. 2020). Influencers are seen as authentic experts on products they specialize in reviewing, such as cameras, laptops, or smartphones. Moreover, their recommendations carry weight with relevant follower bases. For example, unboxing videos by influencers give potential customers authentic usage impressions and comparisons between electronics products and these further shapes opinions and drives purchases.

The interactive, real-time nature of social media allows followers to directly ask influencers questions. It has been identified that two-way communication builds trust and sways decisions. Influencers are a cost-effective alternative to celebrity endorsements for newer, lesser-known electronics brands trying to build market presence. It has been observed that even micro-influencers with under 10,000 followers can impact niche consumer segments (Song and Kim, 2020). However, there are risks of influencers losing credibility in case seen as overly promotional or paid by brands. On the other hand, disclosure and authenticity are imperative to maintain trust.

While celebrities tap into aspirational appeal, influencers drive recommendations through real-life usage. Electronics companies leverage both strategies to target mainstream and specialist consumer domains.

Celebrity endorsements aim for mass-market mindshare while influencers nurture niche communities online (Thomas, and Fowler, 2021). Their combined impact on consumer preferences is greater than each individually. However, the effects are indirect and difficult to quantify, unlike direct sales numbers. Rigorous analytics are required to measure true returns on such marketing investments. Ongoing social listening is necessary to spot negative reactions and promptly manage brand reputation, apparently, consumer interactions need to be carefully monitored. Celebrity and influencer marketing provide cost-efficient methods for consumer electronics companies to boost awareness, shape preferences, and drive adoption. However, prudent selection and management of brand representatives are key to maximize returns.

Figure 2.3: Effectiveness of advertising and promotions

(Source: Self-Developed)

Advertising and promotion are crucial in the consumer electronics industry for influencing consumer attitudes and purchasing behaviour (Hanaysha, 2022). These initiatives were created to express curiosity, raise awareness, and ultimately increase sales of goods and services. Businesses create a distinctive brand identity that appeals to consumers using a variety of media platforms, including television commercials, print ads, and online advertisements. Furthermore, by developing a distinctive brand identity, businesses can set themselves apart from rivals, raise brand awareness, and win customers' interest and loyalty in the fiercely competitive consumer electronics market. Advertising and promotional efforts significantly affect consumer purchase choices by highlighting the advantages and characteristics of products and services (Chopra et al. 2020). Product evaluations, demonstrations, and other promotional content can successfully assist firms in achieving this goal. In addition, by emphasising the features and benefits, a consumer's curiosity is aroused, and their capacity to make an informed purchase decision is boosted (Schouten et al. 2021). Promotions, including discounts, coupons, giveaways, and limited-time offers can foster a sense of urgency among customers, influencing their perceptions and purchasing decisions. In case, there is a sense of urgency, consumers may be more inclined to test or purchase a product they hadn't previously considered, which could increase sales and market penetration.

Advertising and promotions play a pivotal role in influencing consumer attitudes and purchase behavior when it comes to consumer electronics products (Hanaysha, 2022). These marketing activities aim to stir interest, raise awareness, and ultimately boost sales. Television and online video advertisements are commonly used in the consumer tech space to showcase product features and key benefits through compelling demonstrations. It has been observed that dynamic, visual storytelling formats engage viewers. For example, Apple's classic silhouette ads for iPods featuring people dancing with white headphones creatively depicted the product's lightweight, fun image. The catchy songs further enhanced memorability. Humour is another effective advertising appeal for consumer electronics to grab attention, keep audiences entertained, and communicate user-friendly features. It has been identified that amusing situations related to using tech devices resonate with consumers.

However, advertising need to also provide relevant product information to educate and assist the consumer's purchase decision process. Detailed tech specs, user reviews and comparison charts are now common in online advertisements. Advertisements placed on targeted websites related to consumer tech allow companies to contextually reach audiences actively interested in learning about and buying new gadgets, this boosts advertisements relevance of advertisements (Pop et al. 2022). Promotional activities such as giving free samples and demonstration units to retail outlets gives potential customers first-hand experience with products before purchasing. Trying devices can powerfully influence buying decisions and brand perceptions. Price promotions through discounts, rebates and bundle offers drive sales by prompting purchase consideration and decisions. Limited-time discounts make offers feel more exciting and exclusive to boost response.

Giveaways of electronics products through contests and competitions provide buzz while expanding the customer base with new user trials that could lead to repeat purchases. It has been identified that generating leads is easier with free giveaways. Referral programs encourage existing customers to promote products among their social circles in return for rewards (Moraes et al. 2019). Trusted peer recommendations add credibility that traditional ads often lack. The key to effective consumer electronics advertising and promotions lies in coordinated campaigns across media channels and sales networks. Integrated messaging creates a synergistic impact on consumer perceptions. However, companies need to exercise caution to not overhype product capabilities beyond realistic performance through excessive hype in advertisements or giveaways and this leads to dissatisfaction among buyers.

Advertising and promotional effectiveness need to be continually measured through surveys, sales contribution analysis and online engagement metrics (Aghaei and Alarsali, 2022). Consumer response metrics guide optimal spend allocation across activities. In the digital age, personalized and interactive engagements are becoming more important than one-way broadcast messaging to shape preferences. Creative integration of emerging technologies such as AI, AR and VR in advertising and promotions can capture consumer mindshare amid intense competition.

2.3 Background and definitions

Brand recognition and reputation significantly impact consumer decisions and purchase behaviour in the consumer electronics sector. A brand's historical performance, general reputation, and familiarity significantly influence consumer views and purchases. The long-standing reputations of companies such as Xiaomi, Samsung, and Apple encourage consumer preference and confidence. Customers' purchasing decisions and brand loyalty are significantly influenced by brand reputation. Consumer electronics companies must manage and improve their brand reputation to acquire a competitive advantage and build long-lasting customer relationships (Prasad et al. 2019). Its reputation can influence customer perceptions of a brand's quality, reliability, and trustworthiness. Furthermore, this can increase brand preference, brand loyalty, and purchase intent. On the other hand, a poor brand reputation can lead to lower consumer confidence, lower purchase intentions, and even brand switching.

Brand recognition and reputation have a profound influence on consumer preferences and purchase decisions when it comes to consumer electronics (Palalic et al. 2021). In this industry, the brand name often supersedes product specifications and features in the consumer's mind. Brand recognition refers to consumers' ability to identify a brand when prompted with cues such as the name, logo, or slogan. Top consumer electronics companies invest heavily in advertising and marketing communications to build brand recognition. When making purchase decisions, consumers tend to prefer brands that are highly recognizable in the market. Building brand recognition requires repeated exposures through ads, stores, events sponsorships and so on. The more consumers see the brand, the h4er the memory associations become. In addition, this increases mental availability and ultimately brand choice.

High recognition gives companies an edge when launching new products as customers already know and trust the brand name (Dhaliwal et al. 2020). Recognizable brands also enjoy more leeway with pricing as customers focus on brand familiarity. Brand reputation refers to consumers' perceptions of the brand's quality, reliability, performance, and other associations. A h4 reputation shapes preferences by signalling a brand's superiority over competitors. In consumer electronics, Samsung's reputation for product innovation, Apple's reputation for ease of use, and Sony's reputation for audio-visual quality guide customer choices. A good reputation builds trust and confidence in the brand.

Reputation stems from direct brand experiences, endorsements, reviews, awards, and subjective perceptions unique to each customer (Chin et al. 2020). Positive experiences and third-party validation build a h4 reputation over time. A bad reputation due to product defects or negative press damages consumer confidence. Companies such as Samsung have recovered from reputation crises through proactive PR and quality improvements. Brand reputation impacts consumers' willingness to pay a premium for certain brands seen as higher quality or status symbols, such as iPhones, as perceived brand superiority justifies paying more.

Reputation also engenders brand loyalty, for which consumers will continue rebuying from brands reputed for reliability, performance, style, and so on (Boz et al. 2020). This loyalty prevents switching even when competitors offer similar specs at lower prices. In specialized segments such as photography equipment, Canon and Nikon's outstanding reputations have locked in loyal user bases that represent a major barrier to entry for newcomers. Brand reputation serves as a competitive barrier that makes it extremely difficult for new entrants to challenge established players in consumer electronics in the short run (Porter, 2008). However, companies cannot rest on past laurels, as failure to innovate erodes reputation over time. Thus, electronics purchase decisions are guided by brand recognition and carefully nurtured reputations around intangible attributes such as innovation, design, and prestige. Companies need to continue delivering on their brand promises to maintain loyalty and preference amid rapidly evolving consumer expectations.

2.4 Seminal research and theory

Kegoro and Justus (2020) define brand equity theory as the value a brand adds to a product. Brand equity is crucial for establishing and maintaining a competitive edge in the market. It is based on how consumers perceive a brand and determine its value. Brand awareness, loyalty, and affiliation are some factors that might affect how people feel about a specific brand. The theory h4ly emphasises the importance of fostering emotional connections with customers to foster brand loyalty and influence decision-making. Subsequently, brands may strengthen and deepen client loyalty by creating emotional bonds and eliciting feelings of greatness.

Brand awareness refers to how easily consumers can recall or recognize a brand. Higher brand awareness typically signals to consumers that a brand is popular, reliable, and trustworthy. Brand loyalty denotes how regularly and consistently consumers purchase from the same brand over time. Loyal customers are less likely to switch to competitor products. Brand associations are any associations, qualities, or characteristics that consumers mentally link to a brand. Favorable associations can drive preferences and choices. According to brand equity theory, consumers attribute extra value and preference to brands they view positively (Bae et al. 2020). Furthermore, by actively fostering h4, favorable consumer perceptions and emotional connections to the brand, companies can establish higher brand equity in the minds of their customers.

One of the key ways companies can build brand equity is by cultivating brand loyalty through emotional bonds (Zhang et al. 2021). When consumers feel a personal affinity or emotional attachment to a brand, they are more likely to habitually purchase it over competitors. Brands essentially become part of the consumer's self-identity. This loyalty based on emotional connection is much harder for competitors to break than loyalty based on rational calculations of value or quality. Brand equity theory thus places great emphasis on brands continually strengthening consumer loyalty by eliciting positive emotions such as optimism, belonging, and nostalgia related to the brand experience. Building intimate, emotional bonds creates feelings of goodwill and affection towards the brand. This subsequently influences consumer decision-making by driving preferences, recommendations, and repurchases. Thus, brand equity theory highlights that brand which successfully foster h4 awareness, loyalty, associations, and emotional connections can leverage higher equity to achieve a sustainable competitive advantage. The emotional resonance of branding has the power to shape consumer perceptions, attract customers, and deepen loyalty over time.

2.5 Contemporary research

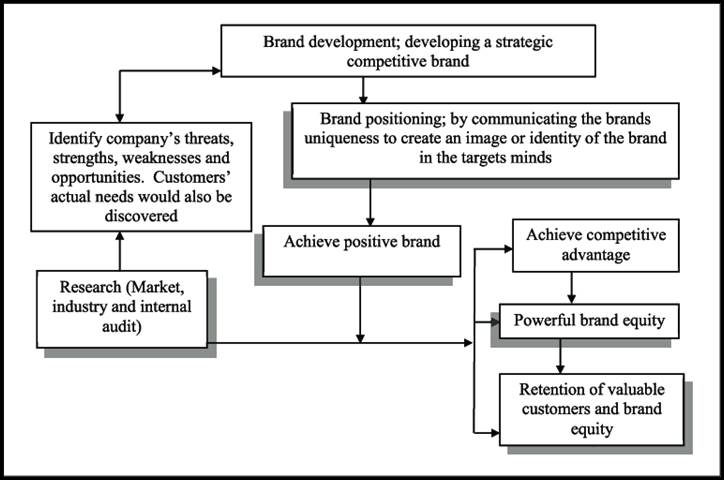

Figure 2.4: Brand building for competitive advantage

(Source: Naatu, 2016)

Branding is crucial in the consumer electronics sector since it directly affects a brand's ability to compete. According to Lee and Falahat (2019), an effective branding strategy can set a company's products apart, increase brand recall and awareness, and foster fulfilling customer connections. Consumer electronics companies can achieve a unique position in the market and a h4 brand identity and image by developing a USP. Businesses can differentiate themselves from the competition and get an advantage in the intensely competitive consumer electronics market by gaining the attention and loyalty of their customers (Behera et al. 2020). The importance of branding in consumer electrical devices is highlighted by the fact that consumers' perceptions of a smartphone brand as being more innovative or trendy than its rivals can significantly influence their purchasing decisions. Additionally, branding is important for encouraging customer loyalty and brand preference. Customers may select a certain laptop brand, for instance, based on favourable prior experiences and confidence in the company's offerings. Due to the brand's reliability and trustworthiness, consumers are more inclined to choose it over rivals and stick with it. Consumer electronics companies can stand out, draw in and keep customers, and maintain a competitive edge by developing consumer trust and consistently providing great experiences.

Branding plays an instrumental role in fostering competitive advantage and market success for companies operating in the consumer electronics industry (Manzoor et al. 2020). In a crowded market, branding is what sets a product apart and makes it the preferred choice of target consumers. Branding goes beyond just the name and logo to encapsulate everything that forms the unique identity of a consumer tech company and shapes perceptions in the minds of its customers. For example, Apple has built a h4 brand identity that resonates with users who value design simplicity, premium quality, and seamless integration, this has driven enduring competitive advantage.

Branding conveys intrinsic qualities that cannot be copied by competitors. The brand associations, personality, values, and imagery constitute valuable intellectual property exclusive to each company. Furthermore, by building brand equity and loyalty over time through consistent delivery of the brand promise, companies enjoy insulation from price-based competition and commoditization. Branding enables companies to move away from competing purely on product features and price (Oscarius et al. 2021). Consumers buy electronics products not just for utilitarian needs, however, also for aspirational and emotional value attached to brands. This is reflected in the willingness to pay premium prices for iconic brands. For instance, iPhones command higher prices than Android phones with comparable hardware simply due to the Apple brand appeal.

Branding provides a competitive buffer even when technological gaps between products narrow. Users stick to tried and tested brands because of the familiarity and emotional connection built over time. New consumer tech companies without h4 branding struggle to compete based on product or price alone (Ansari et al. 2019). Building familiarity and loyalty for an unknown brand requires huge investments over several years. The brand reputation around key attributes such as innovation, design, style, performance, and quality also drive competitive advantage by influencing consumer preferences.

Sony's brand carries perceptions of superior audio and video capabilities based on decades of leadership in entertainment technology. This sustains preference despite challengers launching similar spec products. h4 branding fosters partnerships with content creators, retailers, vendors, and other affiliates in the ecosystem. The network effects help reinforce brand equity and dominance. However, brand leaders cannot rest on their laurels. In addition, they need consistent large investments into R&D and marketing to keep delivering product as well as brand innovations better than rising competitors. Consumer tech is an extremely dynamic space with constantly evolving technologies, market segments, and consumer expectations. Brand relevance needs to be continually reinvented to retain a competitive edge. Thus, branding enables consumer electronics companies to rise above commoditized price competition, sustain premium pricing, build loyalty buffers, shape favorable perceptions, and construct barrier to entry for newcomers. However, brands need to be actively nurtured through innovation to stay relevant.

2.6 Literature gap and research question that will be taken forward

While extensive literature examines the importance of branding and marketing for success in the consumer electronics industry, certain specific gaps in knowledge remain. The effects of individual branding strategies like celebrity endorsements and promotions have been widely studied, establishing their impact on consumer perceptions and purchase intent. Additionally, conceptual frameworks provide theoretical understanding of how h4 branding builds competitive advantage by fostering positive brand associations and loyalty. However, past research has focused narrowly on analyzing standalone strategies, lacking a holistic perspective combining multiple integrated branding approaches. Furthermore, quantitative data is lacking on optimal budget allocations across initiatives to guide marketing investment decisions. Though celebrity endorsement outcomes are known, there is limited comparative research on the relative effectiveness of influencer marketing for electronics brands.

Most studies also center on large, established players with h4 existing brand equity, providing limited insights for new entrants. This presents gaps in quantitatively evaluating an integrated branding strategy, measuring returns on marketing spend, comparatively assessing influencer marketing, and formulating branding solutions for smaller firms. The current study aims to address these gaps by adopting a comprehensive approach investigating the combined impact of various branding activities, quantifying their relative returns, comparing influencer and celebrity tactics, and recommending data-driven budget optimization as well as branding solutions for new entrants. The findings will enable managers to make informed, strategic decisions to deploy resources for maximum branding impact.

2.7 Conceptual Framework

Figure 2.5: Conceptual Framework

(Source: Self-Developed)

The conceptual framework visually represents how branding contributes to competitive advantage in the consumer electronics industry. It maps out the key branding strategies companies utilize, such as celebrity endorsements, influencer marketing, advertising campaigns, and sales promotions. These initiatives aim to positively shape important consumer perceptual outcomes, including brand awareness, brand associations, perceived quality, and brand loyalty. When brands successfully manage these knowledge and affinity-based assets, they can gain a significant competitive advantage through being the preferred choice, commanding willingness to pay premium pricing, insulation from price-based competition, and erecting barriers to entry.

The framework outlines how strategic branding efforts create value by moulding what consumers feel and think about a brand. Branding aims to foster h4, favourable brand perceptions and emotional connections. This higher brand equity subsequently drives consumers' preferences and purchase intent. Companies with leading brand equity can achieve competitive differentiation and market success.

2.8 Chapter conclusion

This chapter has highlighted the brand's importance and marketing communication in influencing consumer behaviour within the consumer electronics sector. This chapter has further investigated the role of branding to foster business outcomes by developing marketing strategies. The literature review examines research on branding's role in consumer behavior in the consumer electronics industry. Key topics that have been addressed include branding's influence on consumer decision-making, the impact of brand awareness and reputation on preferences and purchases, and the effectiveness of advertising and promotions in shaping perceptions. The review has highlighted how brand equity derived from factors such as quality, awareness, and loyalty contribute to competitive advantage for firms by driving consumer preferences and purchase intent. However, gaps exist in understanding celebrity endorsement and influencer marketing effects. The review has provided a framework for examining how specific branding strategies affect consumer electronics purchase behavior and firm performance. Further research is needed on measuring returns on branding investments.

3.0 Methodology

3.1 Chapter introduction

The previous chapters established the background, research gaps, objectives, and questions to be addressed through this study on branding and competitive advantage in consumer electronics. This chapter outlines the research methodology adopted to fulfill the study aims. The research design, philosophical paradigm, data collection and analysis techniques are presented. This research employs a quantitative, deductive approach to gather primary data for further analysis. A structured questionnaire was distributed to survey consumer perceptions, preferences, and purchase behavior in relation to branding of consumer tech products. The questionnaire contained Likert scale and multiple-choice questions to produce data for quantitative analysis.

A descriptive research design was chosen to provide numerical insights into the research problem. The positivist philosophical stance guided the methodology to prioritize objective facts revealed through quantitative data. Established scales from prior studies were adapted in questionnaire development to improve validity. The sample, procedure, ethical considerations, and measures to ensure analytic rigor are discussed. The methodology was designed to generate the required data to address the research questions on branding's influence on consumer electronics purchase decisions and brand competitiveness.

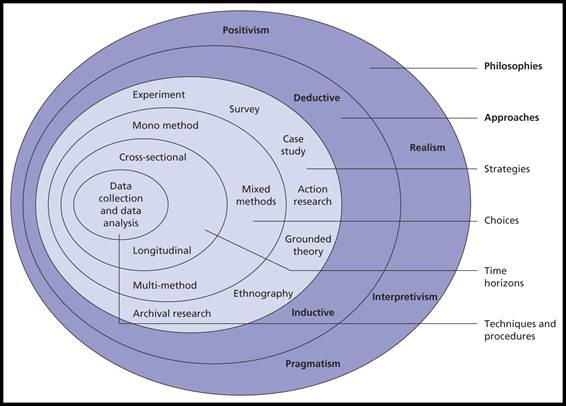

Figure 3.1: Research Onion

(Source: Saunders et al., 2007)

The research onion represents the various layers involved in the methodology process. Moving inwards from the outermost layer, it provides a logical sequence for making choices on philosophy, approach, strategy, time horizon, techniques and procedures aligned to the research objectives, questions, and context. The systematic research onion model helps organize methodological decisions and justify appropriate choices based on the study goals.

3.2 Research design

Figure 3.2: Types of Research Design

(Source: Self-Developed)

The above figure represents the different types of research designs such as descriptive, correlational, experimental, and diagnostic designs. This research adopts a quantitative, descriptive research design to examine branding in the consumer electronics context. Descriptive quantitative studies aim to factually describe characteristics, preferences, attitudes, and other real-world observations from a sample population. A quantitative design was chosen to generate numerical data that allows measurement of consumer perceptions and purchase behavior related to electronics brands. Quantitative data enables systematic analysis to uncover patterns and test relationships between branding aspects and purchase outcomes. A descriptive design was selected since the research objectives include assessing and characterizing key branding influences such as reputation, loyalty, advertising effectiveness and so on.

Descriptive designs

are well-suited for quantifying perspectives and tendencies in a sample through structured data collection tools such as questionnaires (Siedlecki, 2020).The questionnaire developed for this research contains Likert-scale and multiple-choice questions to produce quantitative data appropriate for further analysis. A descriptive quantitative approach also allows generalization of results to the broader consumer population based on the sample surveyed and this aligns with the aim to derive insights that can guide electronics companies in branding strategies to achieve competitive advantage.

On the other hand, descriptive quantitative research using surveys offers certain advantages, this design also has some inherent limitations that needs to be acknowledged. A key restraint is that the numerical data results in a superficial description however does not provide deeper insights into the underlying reasons, contexts and subjective meanings related to the research topic (Bloomfield and Fisher, 2019). The predetermined closed-ended questions also restrict participants from fully explaining their perspectives. Consequently, descriptive designs have limited capability for capturing the subjective aspects of a research problem compared to qualitative studies.

Another limitation is that findings from the sample surveyed may not generalize well to the entire target population. Caution is needed in extracting broad inferences, since the sample may exhibit biases. Descriptive research is also prone to biases stemming from participants' self-reported responses and the artificial survey conditions, which may not reflect actual behaviors and decisions (Mishra and Alok, 2022). Furthermore, while descriptive analysis can identify statistical relationships between variables, it cannot determine causality due to the lack of experimental manipulation.

In terms of analysis, descriptive studies necessitate h4 quantitative skills to properly interpret results. Moreover, the structured methodology itself offers less adaptability to change course based on emerging findings compared to flexible qualitative designs. Capturing context-specific insights usually requires longitudinal data collection instead of a single descriptive survey. In addition, while descriptive quantitative studies efficiently summarize sample characteristics, supplemental qualitative data is often needed to elucidate deeper meanings, contexts, causality, and subjective perspectives. Multiphase mixed methods designs can offset the inherent limitations. However, descriptive surveys remain useful for measuring population parameters, identifying patterns and relationships to address focused research questions of a quantitative nature.

Thus, a descriptive quantitative research design was chosen as it enables collecting measurable data about branding and consumer behavior that can be analyzed to reveal patterns, relationships, and generalizable insights. The design provides an empirical approach to address the research problem and questions. It has been observed that findings can support both theoretical understanding and practical strategies related to branding in the consumer electronics industry.

3.2.1 Philosophy

This study adopts a positivist philosophical stance to research branding in the consumer electronics industry. The key assumption of positivism is that objective facts about a phenomenon can be obtained through empirical observation and measurement. Positivism is suited to quantitative methods and further analysis of data to uncover descriptive relationships (Marsonet, 2019). This aligns with the current research since the aim is to quantify consumer perceptions and preferences through a structured survey to reveal measurable insights about branding. A positivist approach allows detecting patterns and testing theories about how branding elements such as reputation and loyalty impact purchase intent and choices.

![]()

Figure 3.3: Types of research philosophy

(Source: Self-Developed)

The above figure highlights the different types of research philosophy such as positivism, pragmatism, interpretivism and realistic. A positivist approach was chosen as the research questions seek to empirically assess and measure various branding aspects and their influence on consumer decision making in an objective manner. The goal is not to explore subjective meanings however gather observable, quantifiable data on consumer views and behaviour in relation to electronics brands.

Positivism philosophy

supports the use of validated scales and pre-established theories to design a structured questionnaire survey that avoids bias (Park et al. 2020). Resulting data can be analyzed to reveal significant relationships and contributions of branding constructs in shaping advantages for consumer electronics firms. Since the focus is on quantifying responses rather than qualitatively interpreting meanings, a positivist paradigm provides an appropriate philosophical framework. It allows leveraging existing branding theory to deductively develop research questions while prioritizing external validity. The methodology is designed to produce generalizable insights into how effective branding delivers competitive edge based on consumers' observable preferences and behaviors in the electronics market. Thus, a positivist research philosophy underpins the current methodology to facilitate empirical investigation of branding's impact using a survey instrument and in-depth analysis. In addition, this offers objectively measurable theoretical and practical insights.3.2.2 Approach to theory

This research adopts a deductive approach, where existing theories and literature on branding inform the development of research questions to be tested through primary data collection. A

deductive approach

moves from the general to the specific broader principles from branding theory are first used to identify research gaps (Young et al. 2021). This aligns with the current study, which leverages established branding models to investigate relationships between specific elements such as reputation, endorsements, and consumer loyalty. Pre-defined scales measuring each construct are adapted from prior studies into the survey questionnaire.For example, the celebrity endorsements positively influence purchase intent is assessed by measuring the correlation between endorsement effectiveness and buying decisions empirically. The deductive flow is from theory to specific inquiry. An inductive approach beginning with broad data collection was not appropriate here, as the focus is on testing branding theories (Pandey, 2019). The deductive theorizing also improves validity and generalizability by grounding the research model and instrument in robust academic frameworks. Moreover, the deductive approach provides a structured process to guide this quantitative study that is starting from identification of theoretical branding constructs as variables to empirical testing of relationships between these variables in the consumer electronics context through further analysis of collected survey data (Love and Corr, 2022). The sequential flow of deductive reasoning allows deriving testable methods from branding concepts that can address the research questions. It has been observed that findings can also inform the development of branding theory. However, the broad emphasis is on deducing and validating effects based on existing theoretical models of branding effectiveness.

3.2.3 Methodological choice

This study adopts a quantitative methodology using a structured survey instrument to collect primary data from consumer electronics buyers. A descriptive, cross-sectional survey design enabled gathering measurable insights on consumer perspectives on branding for statistical analysis to test hypotheses grounded in existing theory. This aligned with the deductive approach and positivist philosophical stance.

3.2.4 Strategy

This quantitative, descriptive study utilizes a structured survey questionnaire as the primary research strategy to gather data about consumer perspectives on branding within the electronics industry. Survey research is well-suited for descriptive studies aiming to quantify attitudes, beliefs, preferences and behaviors within a population sample. The survey questionnaire accordingly contains Likert-scale and multiple-choice questions to collect numeric data on key branding constructs.

The survey instrument was designed to measure the different independent, mediating, and dependent variables in the conceptual research framework. Multi-item scales adapted from established branding literature were used to improve validity and reliability. Online distribution of the survey was chosen as a cost-effective means to access a large, diverse sample representative of the target population. Email, social media, and consumer forums enabled reaching prospective respondents from varied demographics.

Pre-testing of the questionnaire provided feedback to refine the survey structure, questions, and scales before full deployment. An online format offered convenience and flexibility to respondents as well as anonymized responses reduced evaluation apprehension. The quantitative survey data enables analysis of relationships between branding elements and consumer decision making using several techniques. Thus, online distribution of a carefully designed, pre-tested survey questionnaire was adopted as the key research strategy in this deductive, descriptive study to generate consumer-based data on branding suitable for quantitative analysis in relation to the research objectives as well as this strategy aligned with the positivist approach.

3.2.5 Time horizon

This study utilizes a cross-sectional time horizon to examine the impact of branding on competitive advantage in the consumer electronics industry. A cross-sectional survey conducted at a single point in time was determined appropriate to address the descriptive, deductive research aims of assessing current consumer perceptions, preferences, and purchase behaviours related to electronics brands (Wang et al. 2020). The survey methodology allowed efficiently gathering quantifiable snapshot data across sample participants to develop relationships derived from existing branding theory and literature. While longitudinal tracking of changes was not feasible within scope, the cross-sectional approach enabled gathering sufficient empirical data to perform robust statistical analysis and modeling to derive insights on branding effectiveness.

3.3 Data collection

This study employs a questionnaire-based survey to collect

primary quantitative data

assessing consumer perceptions and purchase behavior related to branding of consumer electronics. A survey was determined as the most appropriate data collection method given the descriptive, deductive research design. Surveys allow gathering measurable data around predefined constructs that can be systematically analyzed (Ali, 2021). The survey instrument contains closed-ended questions with Likert scales and pre-coded responses. This structured approach controls for biases and provides quantitative data suited for modeling branding's impact on consumer decision making. Using validated scales adapted from prior branding studies improves reliability. Online distribution of the survey through email, social media and forums enabled accessing a large, diverse sample at low cost.The survey questions measure key branding aspects such as brand reputation, celebrity endorsements, and advertising effectiveness. Demographic questions are also included. Analyzing response correlations and differences between groups provides insights into branding. Pre-testing of the questionnaire helped refine the items and format. An online format provided convenience to respondents. Anonymity was maintained to reduce evaluation apprehension and encourage candid responses. The quantitative survey data facilitates understanding branding's influence on competitive advantage in consumer electronics through statistical analysis of the response trends and relationships between various branding metrics and purchase intent. Thus, a structured survey was determined as the most fitting primary data collection method for this quantitative study aiming to measure branding's impact based on consumer perspectives. Online distribution enabled efficient gathering of responses. The questionnaire approach aligned with the deductive testing of theory-based methods around branding effectiveness in the empirical context.

The literature search and screening process applied both inclusion and exclusion criteria to identify the most relevant academic papers aligned with the research topic. Only peer-reviewed journal articles and conference papers focused specifically on branding within the consumer electronics sector were included. The scope was limited to studies published in the last 5 years examining various branding strategies, brand equity, identity and reputation, and their impact on consumer psychology and purchase behaviors. Papers had to contain empirical findings or conceptual models with clear relevance to the research questions. Literature reviews or technical reports lacking original insights were excluded, as were studies limited to only one company or geographical market. Additionally, new articles, opinion pieces, and content focused too narrowly on product features without a branding lens were excluded. Applying these criteria ensured the literature review covers high-quality, recent academic research offering industry-wide insights on branding and consumer behavior in the context of consumer electronics. Around 80 relevant papers were identified through initial keyword searches and subsequent screening.

3.4 Research instrument(s)

The key research instrument utilized in this study was a structured questionnaire administered through an online survey. The questionnaire contained 24 questions using 5-point Likert scales and multiple-choice formats designed to quantify consumer perspectives and purchase behaviors related to branding in the consumer electronics industry. The survey instrument was developed by adapting validated measures from prior academic studies on branding to suit the current research context. Questions capture data on variables including brand reputation, loyalty, celebrity endorsements, and willingness to pay price premiums. The quantitative survey methodology facilitated statistical analysis of consumer viewpoints to yield data-driven insights.

3.5 Population and sampling strategy

This study utilizes a non-probability sampling technique to select participants for the survey questionnaire. Since probability sampling was not feasible given practical constraints, purposive sampling was determined appropriate for the descriptive, quantitative nature of the research (Fawns-Ritchie, and Deary, 2020). With purposive sampling, the researcher deliberately selects participants meeting the study criteria from the target population. This research required respondents who actively purchase consumer electronics to provide valid insights on branding in this domain. The sample was recruited by posting the survey link online on electronics forums, social media groups related to gadgets, and affiliate marketing channels with technology user bases. This enabled access to relevant target respondents.

A total sample size of 51 respondents provided adequately robust data for descriptive analysis as per conventions proposed for quantitative surveys. A sample exceeding 30 allows reasonably stable statistical estimates. The 51 responses generated sufficient data points to perform survey to address the research questions. The purposive sampling approach allowed identifying and selecting appropriate participants fulfilling the scoping needs of the study, thereby improving applicability of findings. However, limitations exist in generalizing results to the broader population. While probability sampling would increase external validity, purposive recruiting was more feasible.

Thus, a non-probability purposive sampling technique was adopted for this quantitative questionnaire-based study to recruit 51 participants meeting the criteria of being active consumer electronics buyers. This sampling aligns with the descriptive goals of the research and enabled accessible sourcing of targeted respondents to generate a sample set adequate for envisaged statistical analysis. While not generalizable, findings provide specific insights on branding effectiveness for the electronics consumer domain.

3.6 Data analysis tools and techniques

This research will employ quantitative data analysis techniques aligned with the descriptive, positivist nature of the study. Quantitative analysis allows deriving measurable insights from numeric data gathered through structured questionnaires (Mohajan, 2020). Measures such as percentages, means, frequencies and standard deviations will summarize overall response patterns and trends for each questionnaire item and key branding construct. Charts and tables will visualize results of the survey that has been performed. This will summarize overall response patterns and tendencies in the sample. Frequency tables will present absolute and relative counts of responses to each question item. Bar charts, pie charts, and line graphs will provide visual representations of response distributions.

3.7 Study quality and limitations

This research limits generalizability threats to external validity by using a larger sample size and recruiting participants meeting key criteria as active electronics consumers. However, convenience sampling still restricts external validity compared to random approaches. Thus, concerted efforts to boost reliability and different aspects of validity throughout the descriptive quantitative study increase accuracy and reduce systematic biases. Although limitations exist, measures employed in questionnaire design, pre-testing, sampling, and in-depth analysis substantiate the validity and reliability of findings to a considerable extent, adding rigor. Moreover, adaptations of established measures, pre-testing, anonymous responses, appropriate sampling, factor analysis and other steps provide a degree of confidence in the reliability and validity of results, supporting the credibility of this quantitative survey research.

3.8 Ethical considerations

Several ethical considerations were accounted for in the design and conduct of this study as per standard research ethics principles of respect, beneficence, and justice. It is essential to note that, participation was entirely voluntary. The survey introduction disclosed the nature and purpose of the research. Respondents could choose not to participate or withdraw anytime without prejudice. Coercion was avoided by not offering excessive incentives that could unduly influence involvement. An ethical concern with surveys relates to obtaining informed consent (Hasan et al. 2021). For this online study, a consent form was provided explaining key details such as data usage, withdrawal option, anonymity and risks or benefits prior to survey access. Respondents had to affirmatively indicate consent before proceeding.

Participant anonymity and confidentiality were maintained as surveys contained no identifiable personal information. Anonymous responses reduced apprehension of judgement or ramifications for honest responses (Broesch et al. 2020). Data was aggregated for analysis. Secure data handling using password-protection and encryption ensured confidentiality. Another relevant ethical issue is potential harms or costs to participants versus benefits. This non-interventional survey research posed minimal risks of discomfort or stress. However, boredom and time spent were costs incurred. However, societal benefits of adding to branding knowledge outweighed such costs.

Regarding compensation, a lottery incentive for Amazon vouchers was deemed suitable and not coercive for the time invested. Compensation details were transparently communicated beforehand. Justice and inclusiveness principles were addressed by allowing any qualified, willing participants to voluntarily take part. Opportunity to participate was not restricted whereas sociodemographic data enabled analyzing in case sample represented target population parameters. However, selection bias existed due to non-probabilistic sampling. Thus, typical research ethics considerations around consent, minimizing harm, anonymity, confidentiality, security, transparency, optional involvement without coercion, appropriate incentives, inclusiveness, and social benefits were adequately addressed in this descriptive survey study. This maintained participant rights, dignity, and wellbeing. Formal approval was obtained from the affiliated institution's ethics review committee prior to data collection.

3. 9 Chapter conclusion

This chapter presented the research methodology adopted for this study examining the impact of branding on competitive advantage in the consumer electronics industry. A quantitative, descriptive design was determined suitable for measuring consumer perspectives on electronics branding to address the research gaps and questions. The positivist approach enabled collecting empirical data for in-depth analysis. Survey methodology offered a structured means to gather quantifiable insights around key branding constructs identified in the literature. Non-probability purposive sampling recruited 51 active consumer participants.

Rigorous questionnaire design, pre-testing, adapted scales and anonymous responses helped boost validity and reliability. Online distribution provided efficient data collection. Quantitative analysis techniques were outlined to analyze patterns, relationships, and predictions from the survey data. The methodology balances rigor with feasibility to fulfill the descriptive, deductive research aims. Reasonable steps were taken to address relevant ethical considerations and protect participant welfare in the survey process. Thus, this quantitative methodology obtains measurable insights on branding in the consumer electronics context to advance understanding and provide data-driven recommendations.

4.0 Results/Findings and Discussion

4.1 Chapter introduction

This chapter presents the key findings that emerged from the quantitative analysis of the survey data collected to investigate branding in the consumer electronics industry. The results are organized thematically based on the research questions and variables examined. Key relationships between branding factors and consumer behavior are highlighted. The chapter then discusses the implications of these findings in relation to existing academic literature and practical implementation for managers in the consumer tech sector. In addition, comparisons are made with prior studies and limitations acknowledged.

4.2 Participant demographic overview / sample overview

The online survey yielded a total sample of 51 responses. The sample comprised 64% male and 30% female participants. In terms of age distribution, the majority were 18-34 years old that is 70%, followed by 35-44 years that is 20% and 45-54 years that is 8%. It has been observed that only 2% were over 55 years old. Most respondents that is 57% were students, while 12% were managers, another 12% supervisors, and 6% business owners. This indicates a young, educated sample with managerial aspirations. Regarding consumer electronics purchase frequency, 39% bought products 1-3 times a year while 24% purchased 4-6 times annually. 14% were frequent buyers who purchased consumer electronics over 10 times yearly. It has been identified that only 4% had never purchased.

Thus, the sample represents the key target demographic of young, tech-savvy consumers who regularly purchase consumer electronic gadgets. While not nationally representative, the sample gave adequate insights into the research questions from the perspective of a major electronics consumer segment. Larger samples in future studies can improve generalizability. The self-selected nature of survey participation may have skewed the profile towards more technology-oriented, educated youth. However, the sample gave useful perspectives to analyze branding's impact.

4.3 Results

Figure 4.1: Consent

(Source: Self-Developed)

The consent question asked respondents to indicate their willingness to participate in the survey. Out of the 51 total responses, 94% that is 48 consented to take the survey by agreeing to the consent statement while only 6% that is 3 declined participation. The high rate of consent suggests respondents were sufficiently informed about the survey's purpose and data usage through the explanation provided. It indicates most contacted sample members recognised the study's benefits and were willing contributors. The few who declined were allowed to freely exit, upholding voluntary participation. Thus, consent was adequately obtained from the large majority of respondents who completed the questionnaire.

Figure 4.2: Gender

(Source: Self-Developed)

The gender distribution of respondents was as follows that male constituted the majority at 63% that is 32 while females comprised 29% that is 15. It has been observed that only 2% that is 1 preferred not to disclose gender. The higher share of males could be attributed to the online questionnaires being distributed primarily on technology forums and groups where male participation is higher. However, nearly one third being female provides a reasonable gender balance. The sample is moderately aligned with the electronics consumer demographic which skews more male but with rising female uptake. Thus, the sufficiently large subsample of both genders offers useful insights into potential variations in branding perspectives by gender in this target population.

Figure 4.3: Occupation

(Source: Self-Developed)

The sample comprised mainly students at 57% that is 29. Managers constituted 10% that is 5% while supervisors and business owners represented 12% that is 6 and 6% that is 3 respectively. In addition, the remaining 16% that is 8 were categorized as other occupations. The prevalence of students reflects the youthful, tech-savvy target profile and the online questionnaire distribution through forums frequented by student communities. However, the sample also includes managerial perspectives allowing for some assessment of variations in branding views between students and professionals. The mix provides reasonable diversity from an occupational standpoint among the frequently targeted electronics consumer segment of youth and young professionals.

Figure 4.4: Importance of branding in influencing purchasing decisions for consumer electronic products

(Source: Self-Developed)

It can be identified that 33% that is 17 participants felt branding was very important and 24% that is 12 participants extremely important in influencing purchasing decisions. Approximately 13% that is 7 participants considered it slightly important. This highlights the critical role of branding in the minds of most electronics consumers when making purchase choices.

Figure 4.5: Brand consumer electronics products influence

(Source: Self-Developed)

From the above figure, it can be identified that 41% that is 21 participants stated brands very much influence their perception of product quality and reliability. Approximately 18% that is 9 participants said brands influence completely. Moreover, 59% indicate significant branding impact on quality beliefs. In addition, only 12% that is 6 participants felt brands slightly influence quality perceptions. The h4 branding role in driving quality evaluation is evident.

Figure 4.6: Selecting a well-known brand over a lesser-knonw brand for consumer electronic products

(Source: Self-Developed)

It has been observed that 21% were neutral however 22% likely and 18% very likely show the appeal of established brands.

Figure 4.7: Regarding celebrity/influencer endorsements

(Source: Self-Developed)

From the above figure, it can be identified that approximately 31% that is 16 participants considered them very influential and 14% that is 7 participants extremely influential in purchase decisions, indicating h4 endorsement impact. However, 14% that is 7 participants saw little influence, demonstrating mixed effects overall.

Figure 4.8: Brand loyalty

(Source: Self-Developed)

It has been identified that around 33% gave it very high importance and 20% considered it extremely important for repurchasing. Furthermore, over half display h4 loyalty that drives repeat purchases from favored brands. However, 14% indicated mild importance, pointing to some consumer variety-seeking.

Figure 2.9: Branding differentiation

(Source: Self-Developed)

It has been identified that 31% felt brands very much differentiate products in the market and 18% said brands completely differentiate items. In total, 49% indicate branding h4ly establishes product distinctions. However, 18% said brands only slightly differentiate. This shows most believe branding creates separation but some see products as more homogenous.

Figure 2.10: Recommendation likelihood

(Source: Self-Developed)

It can be observed that approximately 35% that is 14 participants were likely to recommend brands they had positive experiences with and 27% very likely. Furthermore, 62% that is 18 participants display readiness to refer brands they enjoy. However, 6% were unlikely to recommend, indicating promotional opportunities.

Figure 2.11: Regarding consumer electronics brands' use of branding for competitive advantage

(Source: Self-Developed)

It has been noted that almost 25% thought brands utilize it very well and another 25% believed brands leverage it extremely well. In total, half the respondents gave h4 ratings for brands' branding competitiveness. However, 24% felt brands only use it slightly well. This indicates most believe consumer tech companies skillfully employ branding to compete, but some see untapped potential.

Figure 2.12: Advertising/promotion influence on purchase decisions

(Source: Self-Developed)

From the above figure, it can be identified that 33% said it sways them moderately and 24% stated it impacts very much. In addition, over half confirm notable branding effects on their purchases. However, 14% reported minimal influence, elucidating advertising effectiveness variations.

Figure 2.13: Willingness to pay premiums for reputable brands

(Source: Self-Developed)